Duuuude. I was blessed with the most amazing gift this week: my student loan debt was forgiven. Erased. Went from almost $150,000 to zero in a matter of seconds. My family came from humble means. We were solidly middle class, and I never lacked for necessities and even modest luxuries, but I lived in a 2 bedroom/1bath condo and shared a bedroom with my younger brother until I was 16 years old. My parents carried a ton of credit card debt in order to provide for us. We got skating lessons and Nintendo, while they worried at night about making ends meet. As such, they were unable to pay for my college and medical school costs, and I took on an enormous amount of debt to put myself through school. My student loan debt was well over $300,000 by the time I finished residency at the age of 28. And I have been faithfully chipping away at that debt for the past 19 years. And even after 19 years of paying, I still had $145, 293 left to pay off.

Enter the Biden-Harris administration. Using executive action, Biden announced a temporary waiver to some of the requirements for the Public Service Loan Forgiveness program — a federal aid program that has been in existence since 2007, designed to encourage people to go into lower-paying jobs that benefit the public good, such as teaching, firefighting, serving in the military, or working for a government agency or other nonprofit. It allows for the beneficiary to have their student loan debt erased if they make 10 years’ worth of student loan payments (120 payments) while being employed by a qualifying nonprofit. Until last year, you had to be making payments under a specific repayment program (such as income-based repayment) in order to qualify for loan forgiveness, but the Biden administration temporarily expanded this program for one year (Oct 2021 through Oct 2022) to allow for any type of payment schedule to count, as long as you make 120 payments while working for a qualifying nonprofit. I personally worked for the University of California San Diego (nonprofit) for over 3 years before moving to Los Angeles and working for The Biggest Loser, and I have been an employee of the federal government working as a Veterans Affairs physician at the DC VAMC since 2008. I’ve made way more than 120 payments toward my loans over the past 20 years, so I was cautiously optimistic that I might be able to qualify for loan forgiveness under the new temporary waiver. I submitted my application (on paper via snail-mail!) in mid-October, 2021, and received an acknowledgment of receipt of my application on November 10, followed 2 days later by a letter certifying my employment at the VA as qualifying as public service and notifying me that they would be transferring the servicing of my loans over to them, FedLoan Servicing, in order for them to be able to thoroughly review my payment history. My loans were transferred on November 30, and by December 14 I received a letter saying that I had 93 eligible payments toward the 120 required, and that it could take up to 90 days for a more thorough review. Because I kne I’d made more than 120 payments just while working for the VA, I called their customer service line (along with seemingly millions of other hopefuls, based on the wait time I experienced!) and verified that they had not yet counted the payments I had made prior to consolidating my loans into the federal loan program called DirectLoans, and that they would get to my account sometime in the new year to reassess.

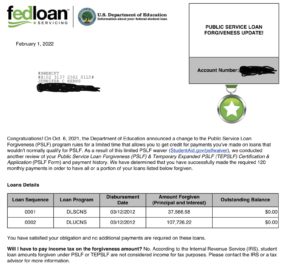

I clearly just had to be patient, and was planning on calling their customer service line by mid-March if I hadn’t received an updated determination by then. I fully expected that to happen because of the incredible volume of new applications they are working through. But a few days ago I got a surprise email from FedLoans and saw the most beautiful sight I’ve seen since Graham was born:  a letter saying that both of my loans are officially forgiven, that my loan balance is now $0.00 and that no further payments are required. I can’t begin to tell you how much happy adrenaline I felt when I saw this letter! I had trouble finishing my work because I was so distracted with joy.

a letter saying that both of my loans are officially forgiven, that my loan balance is now $0.00 and that no further payments are required. I can’t begin to tell you how much happy adrenaline I felt when I saw this letter! I had trouble finishing my work because I was so distracted with joy.

This temporary waiver expires on October 31, 2022, so if you happen to have student loan debt and are working for a nonprofit agency, I highly recommend that you consider applying for the Public Service Loan Forgiveness program now! It can’t hurt to try, and you (like me) just might receive the gift of a lifetime. ❤️

In other happy news, my weight is going down again! I wasn’t perfect this week as far as avoiding sugar and flour, and honestly overate spoonfuls of PB and J, salt water taffy, and a huge slice of buttered toast with cherry jam after I got the news of my loan forgiveness (apparently adrenaline, even happy adrenaline, is something that my primitive brain felt needed to be dampened down with food). But the majority of the week I ate whole foods and made fresh fruit my dessert, and it seems to have paid off! I even cinched my belt down one hole for first the first time in months — woohoo!

Project 135 (resurrected) stats:

week 0 (Jan 1, 2022): 164.4 lbs

week 1: 162.2

week 2: 160.8

week 3: 159.2

week 4: 159.4

week 5 (Feb 5, 2022): 156.4

Total weight loss: 8 lbs (4.9%)

Until next week —

xo Jen

2 Responses

Wowza!!! This is great news! You amaze me in every.single.way! Xo

Aww thank you Caroline! ❤️